What What this means is in your case: When the Fed cuts fascination charges, lenders have a tendency to observe fit. Lenders might begin to lower their charges in late 2024 because of the new cuts, which means afterwards this yr could be a superb time to get reduced costs, though it’s not guaranteed.

Greatest Egg is a good choice for brief financial loan phrases and quick funding. Its minimal loan time period is 36 months, even though the maximum time period is 60 months. Best Egg loans is usually repaid Anytime without having an early payment penalty.

Default is sadly significantly from unheard of — one in five borrowers defaults on their own payday personal loan. In the event your mortgage goes into default, debt collectors can report it to credit history bureaus.

Hard cash improvements usually feature a five% fee of the quantity withdrawn. In addition they are inclined to have better interest charges than standard expenses.

You can’t deduct the desire you shell out on an unsecured private mortgage from your taxes Until you use the financial loan proceeds for enterprise costs, capable increased training fees, or taxable investments.

The predetermined repayment phrase will show you particularly how long it will just take to pay off what you owe.

Purchasing all-around for a personal financial loan could help you save A huge number of pounds in interest and charges, so Review conditions and pricing from a number of lenders to you should definitely get the very best financial loan for yourself. Here’s what to take into consideration:

Submit an application. Payday loans don’t generally demand a credit history Look at, but they will get more info require proof of income and a bank account. Lenders can be obtained on the net or in particular person, dependant upon where you live.

To reduce the amount of You must borrow (and simply how much curiosity you’ll pay), you can get paid some additional funds by:

Downsides: Expenses higher origination fees, only two repayment time period lengths out there, better bank loan quantity minimums in select states

Apart from a credit score score of at the least 620, Realize will ordinarily ask you to provide the following documents and knowledge:

Uncover’s crew of U.S.-dependent loan specialists is obtainable seven days every week to answer questions about your mortgage or your application.

Although this conditional motivation signifies DOE’s intent to finance the venture, EVgo should fulfill sure complex, legal, environmental, and economical disorders prior to the Department enters into definitive funding documents and resources the financial loan.

Should you have bad or honest credit rating, hope to pay more money in curiosity about the life of one's bank loan. In truth, a the latest LendingTree study discovered that elevating your credit score score from “reasonable” to “Superb” could help save you much more than $22,000.

Yasmine Bleeth Then & Now!

Yasmine Bleeth Then & Now! David Faustino Then & Now!

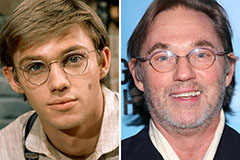

David Faustino Then & Now! Richard Thomas Then & Now!

Richard Thomas Then & Now! Atticus Shaffer Then & Now!

Atticus Shaffer Then & Now! Nicki Minaj Then & Now!

Nicki Minaj Then & Now!